AAFM Chartered Trust & Estate Planner (CTEP) Certification Examination CTEP Exam Practice Test

The Indian Trusts Act, 1882 has _______________ Sections.

Answer : C

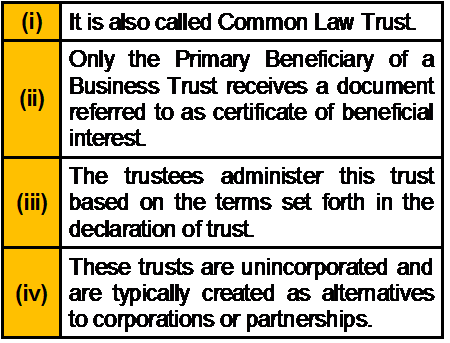

Which of the following statement(s) about Business Trust is/are correct?

Answer : B

As per ______________ of the Indian Trust Act, the subject matter of a trust must be properly transferable to the beneficiary.

Answer : B

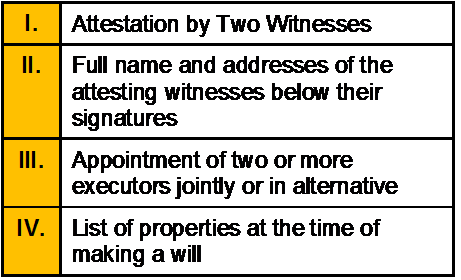

Which of the following is/are the desirable contents of a will?

Answer : B

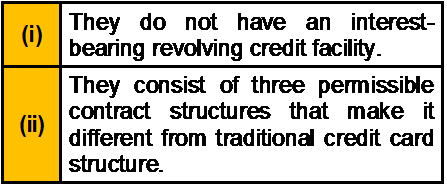

Which of the following statement(s) about Halal Credit Cards is/are correct?

Answer : A

_______________ is a testamentary gift of real property.

Answer : A

____________ lease is typical for business institutions and organizations whose operations rely on a seasonal schedule. ______________ is an option often taken by new businesses which have no credit history.

Answer : D