AAFM Chartered Wealth Manager (CWM) Certification Level II Examination CWM_LEVEL_2 Exam Practice Test

Section A (1 Mark)

Growth stocks typically have high:

Answer : A

Section A (1 Mark)

Deduction under section 80QQB is allowed in respect of royalty income to:

Answer : C

Section B (2 Mark)

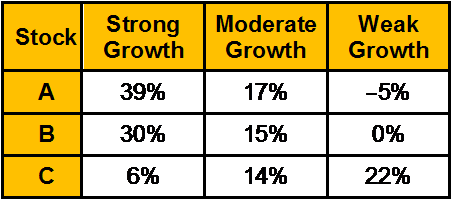

There are three stocks, A, B, and C. You can either invest in these stocks or short sell them. There are three possible states of nature for economic growth in the upcoming year; economic growth may be strong, moderate, or weak. The returns for the upcoming year on stocks A, B, and C for each of these states of nature are given below:

If you invested in an equally weighted portfolio of stocks A and B, your portfolio return would be ___________ if economic growth were moderate.

Answer : D

Section A (1 Mark)

----------- shifts the weights of securities in the portfolio to take advantage of areas that are expected to do relatively better than other areas.

Answer : D

Section A (1 Mark)

Mr. Raghav is now 40 years old. He has invested some amount in an annuity which will pay him after 10 years Rs. 30,000/- p.a. at the end of every year for 10 years. Rate of interest is 6% p.a. Calculate how much he has invested today?

Answer : A

Section A (1 Mark)

How many sections are there in Householder's Insurance Policy?

Answer : B

Section B (2 Mark)

A bank is concerned about excess volatility in its cash flows from some recent business loans it has made. Many of these loans have a fixed rate of interest and the bank's economics department has forecast a sharp increase in interest rates. The bank wants more stable cash flows. Which type of credit derivative contract would you most recommend for this situation?

Answer : D