AAFM Chartered Wealth Manager (CWM) Global Examination GLO_CWM_LVL_1 Exam Practice Test

You have Rs.500,000 available to invest. The risk-free rate as well as your borrowing rate is 8%. The return on the risky portfolio is 16%. If you wish to earn a 22% return, you should __________.

Answer : D

Initial issue expense in respect of the scheme should not exceed ______ of the funds raised during that scheme

Answer : C

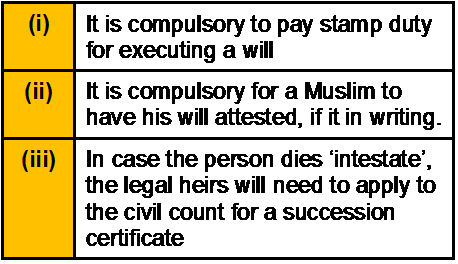

Which one of the following is/are correct?

Answer : B

In case of public company memo must be signed by atleast ....... persons.

Answer : C

In a Mutual Fund Structure as per the latest guidelines the fund sponsor has to contribute:

Answer : B

If a preferred stock pays an annual Rs. 4.50 dividend, what should be the price of the stock if comparable yields are 10 percent? What would be the loss if yields rose to 12 percent?

Answer : B

Pure premium is Rs. 5000. Expenses are 20% of the gross (office) premium. Office premium is

Answer : A