AICPA CPA Financial Accounting and Reporting CPA-Financial CPA Exam Practice Test

According to the FASB conceptual framework, the objectives of financial reporting for business enterprises are based on:

Answer : D

Choice 'd' is correct. The FASB conceptual framework states that the objectives of financial reporting stem from the informational needs of the external users of the information. SFAC 1 para. 28

Choice 'a' is incorrect. Generally accepted accounting principles (GAAP) are derived from and based on the objectives of financial reporting, not the other way around.

Choice 'b' is incorrect. Information concerning management's stewardship is only one aspect of the information financial statements are intended to provide. SFAC 1 para. 50

Choice 'c' is incorrect. Conservatism is an underlying concept for financial accounting but is not the basis for the objectives. SFAC 2 para. 91-97

Which of the following should be disclosed in a summary of significant accounting policies?

i. Management's intention to maintain or vary the dividend payout ratio.

ii. Criteria for determining which investments are treated as cash equivalents.

iii. Composition of the sales order backlog by segment.

Answer : C

Choice 'c' is correct. Il only.

The criteria for determining which investments are treated as 'cash equivalents' is a method of accounting policies that needs to be disclosed in the summary of significant accounting policies.

Choice 'a' is incorrect. Management's intention to maintain or vary the 'dividend payout ratio' is not an 'accounting policy.'

Choices 'b' and 'd' are incorrect. Composition of the sales order backlog by segment is not an 'accounting policy.'

An extraordinary gain should be reported as a direct increase to which of the following?

Answer : A

Choice 'a' is correct. Extraordinary items are reported as a component of net income, after income from continuing operations and discontinued operations.

Choice 'b' is incorrect. An extraordinary gain (or loss) only indirectly affects comprehensive income as a component of net income.

Choice 'c' is incorrect. Extraordinary items are reported net of tax after income from continuing operations and discontinued operations.

Choice 'd' is incorrect. Extraordinary items are reported net of tax after income from continuing operations and discontinued operations.

Income Statement

Which of the following types of entities are required to report on business segments?

Answer : A

Choice 'b' is correct. Only publicly-traded enterprises are required to report on business segments.

Choices 'a', 'c', and 'd' are incorrect, per the Explanation: above.

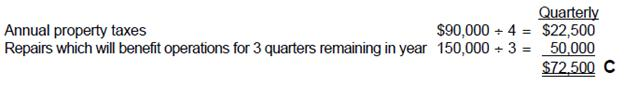

On March 15, 1992, Krol Co. paid property taxes of $90,000 on its office building for the calendar year 1992. On April 1, 1992, Krol paid $150,000 for unanticipated repairs to its office equipment. The repairs will benefit operations for the remainder of 1992. What is the total amount of these expenses that Krol should include in its quarterly income statement for the three months ended June 30, 1992?

Answer : C

Rule: Actual and estimated expenditures benefiting all interim periods equally should be expensed ratably throughout the year.

Choice 'c' is correct. $72,500 total expense for the three months ended June 30, 1992.

On January 2, 1993, Quo, Inc. hired Reed to be its controller. During the year, Reed, working closely with Quo's president and outside accountants, made changes in accounting policies, corrected several errors dating from 1992 and before, and instituted new accounting policies.

Quo's 1993 financial statements will be presented in comparative form with its 1992 financial statements.

This question represents one of Quo's transactions. List B represents the general accounting treatment required for these transactions. These treatments are:

* Cumulative effect approach - Include the cumulative effect of the adjustment resulting from the accounting change or error correction in the 1993 financial statements, and do not restate the 1992 financial statements.

* Retroactive or retrospective restatement approach - Restate the 1992 financial statements and adjust 1992 beginning retained earnings if the error or change affects a period prior to 1992.

* Prospective approach - Report 1993 and future financial statements on the new basis but do not restate 1992 financial statements.

Item to Be Answered

During 1993, Quo determined that an insurance premium paid and entirely expensed in 1992 was for the period January 1, 1992, through January 1, 1994.

List B (Select one)

Answer : B

Choice 'B' is correct. If comparative FS are issued, restate prior year's FS. If comparative FS are not issued, restate prior year-end's retained earnings account by 'adjusting' (net of tax) the opening balance of the current retained earnings statement.

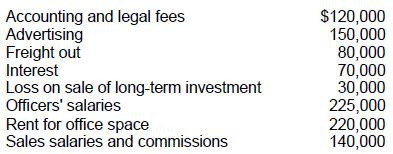

Brock Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative.

The adjusted trial balance at December 31, 1989 included the following expense and loss accounts:

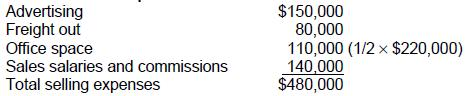

One-half of the rented premises is occupied by the sales department. Brock's total selling expenses for 1989 are:

Answer : A

Note: Only one-half of rent for office space was used for sales office.

Choice 'a' is correct. $480,000.