CIMA BA2 - Fundamentals of Management Accounting CIMAPRA17-BA2-1 Exam Questions

The managing director of a small expanding company has a limited understanding of accounting and has asked you to explain the role of the management accountant in value creation.

Which ONE of the following is NOT a primary role of the management accountant?

Answer : D

Which one of the following is an example of operational management information?

Answer : C

The standard material content of 1 unit of PAJ is 200 (8Kg at 25 per Kg).

During Period 5, 1300 Kg of materials were purchased at a total cost of 35000 and were used to produce 170 units of PAJ.

What was the materials price variance for Period 5?

Answer : A

Which one of the following statements about historical cost and economic value is correct?

Answer : A

The principal budget factor can be defined as:

Answer : B

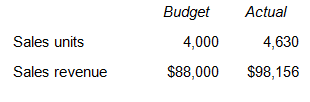

Refer to the exhibit.

The following budget and actual data are available for last period.

The sales price variance for last period was

Answer : A

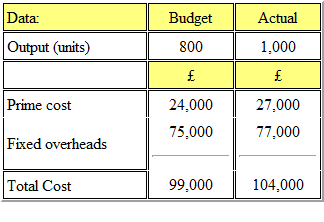

Refer to the exhibit.

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1000 units. The details of the costs are shown below:

The budget expenditure variance was:

Answer : C