CIMA F3 Financial Strategy CIMAPRA19-F03-1 Exam Practice Test

An entityprepares financial statements to 31 December each year. The following data applies:

1 December 20X0

* The entitypurchased some inventory for $400,000.

* In order to protect the inventory against adverse changes in fair value the entityentered into a futures contract to sell the inventory for a fixed price on 31 January 20X1.

* The entitydesignated this contract as a fair value hedge of thevalue of the inventory.

31 December 20X0

* The inventory had afair valueof $480,000 and the futures contract had a fair value of $75,000 (a financial liability).

What will be the impact on the statement of profit or loss and other comprehensive income for the year ended 31 December 20X0 in respect of the change in the value of the inventory and the futures contract?

Answer : C

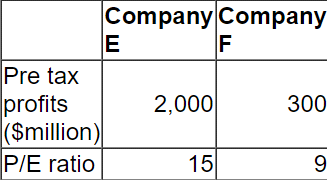

Company E is a listed company. Its directors are valuing a smaller listed company, Company F, as a possible acquisition.

The two companies operate in the same markets and have the same business risk.

Relevant data on the two companies is as follows:

Both companies are wholly equity financed and both pay corporate tax at 30%.

The directors of Company E believe they can "bootstrap" Company F's earnings to improve performance.

Calculate the maximum price that Company E should offer to Company F's shareholders to acquire the company.

Give your answer to the nearest $million.

Answer : A

An unlisted company:

Is owned by the original founder and member of their families.

Is growing more rapidly than other companies in the same industry.

Pays a fixed annual divided

Which of the following methods would be the most appropriate to value this company's equity?

Answer : D

A company's Board of Directors is assessing the likely impact of financing future new projects using either equity or debt.

The directors are uncertain of the effects on key variables.

Which THREE of the following statements are true?

Answer : D, E, F

HospitalXprovides free healthcare to all members of the community, funded by the central Government.

HospitalYprovides healthcare which has to be paid for by the individual patients. It is a listed company, owned by a large number of shareholders.

In comparing the above two organisations and their objectives, which THREE of the following statements are correct?

Answer : E

A company's statement of financial position includes non-current assets which are leased, the tax regime follows the accounting treatment.

Which cash flows should be discounted when evaluating the cost of lease finance?

Answer : A

Company A has made an offer to take over all the shares in Company B on the following terms:

* For every 20 shares currently held, Company B's shareholders will receive $100 bond with a coupon rate of3%

* The bondwill berepaidin 10 years' timeat its par value of $100.

* The current yield on10 yearbonds of similar riskis 6%.

What is the effective offer price per sharebeingmade to Company B's shareholders?

Answer : C