CIMA F3 Financial Strategy CIMAPRA19-F03-1 Exam Questions

Company ABC is planning to bid forcompanyDDD, an unlisted company in an unrelated industry sector to ABC.

The directors of ABC are considering a number of different valuation methods for DDDbefore making a bid.

Which of the following is the MOST appropriate method for ABC to use to value DDD?

Answer : B

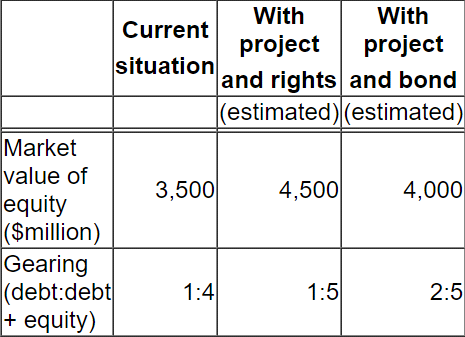

A listed company plans to raise $350 million to finance a major expansion programme.

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of 3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

Answer : A, C

A listed company has recently announced a profit warning.

The company's share price fell 20% on the day of the announcement but had been fairly static in the weeks leading up to the announcement.

Which form of efficient market is most likely to be indicated by this share price movement?

Answer : B

A company has some 7% coupon bonds in issue and wishes tochangeitsinterest rate profile.

It has decided to do this by entering into a plain coupon interest rate swap with it's bank.

The bank has quoted a swap rate of: 6.0% - 6.5% fixed against LIBOR.

What will the company'snew interest rate profilebe?

Answer : C

Company A is unlisted and all-equity financed. Itis trying to estimate its cost of equity.

The following information relates to anothercompany, Company B, which operates in the same industry as Company A and has similar business risk:

Equity beta = 1.6

Debt:equity ratio 40:60

The rate of corporate incometax is 20%.

The expectedpremium on the market portfolio is 7% and the risk-free rate is 5%.

What isthe estimated cost of equity for Company A?

Give your answer to one decimal place.

? %

Answer : A

TU has relatively few tangible assets and is dependent for profits and growth on the high-value individuals it employs. Which of the following statements best explains why the net asset valuator method's considered unstable for TU?

Answer : B

Company M's currentprofit before interest and taxationis$5.0 million.

It has a long-term 10% corporate bond in issue with a nominal value of $10 million.

The rate of corporate tax is 25%.

It plans to continue to pay out 50% of its earnings in dividends and earnings are expected to grow by 3% each year in perpetuity.

Its cost of equity is 10%.

Using the dividendgrowthmodel, advise the Board of Directors of Company M which of the following provide areasonable valuation of Company M's equity?

Answer : B