CIMA P1 Management Accounting CIMAPRO19-P01-1 Exam Practice Test

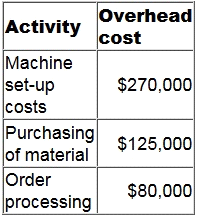

PQR has recently introduced an activity-based costing system.

It manufactures three products, details of which are given below.

The budgeted production overhead costs for the year are shown in table below:

What is budgeted machine set-up cost per unit of Product J?

Give your answer to the nearest cent.

See Below Explanation:

Answer : A

MDS is facing a temporary shortage of Material H which is used to produce all three of its products.

In order to maximise its profitability, which product should be manufactured first?

Answer : B

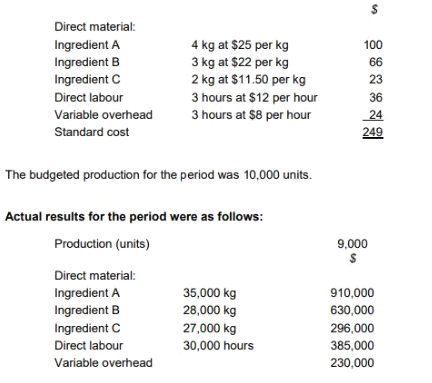

TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers' specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and $20 per kg respectively. TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

What was the material yieldvariance?

Answer : D

Which TWO of the following statements are true for obtaining a reliable forecast from a time series?

Answer : B, C

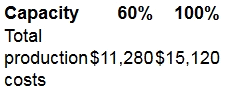

A manufacturing company has a capacity of 10,000 units. The flexed production cost budget of the company is as follows:

All costs are either fixed, variable or semi-variable.

What is the budgeted total production cost if the company operates at 85% capacity?

Answer : A

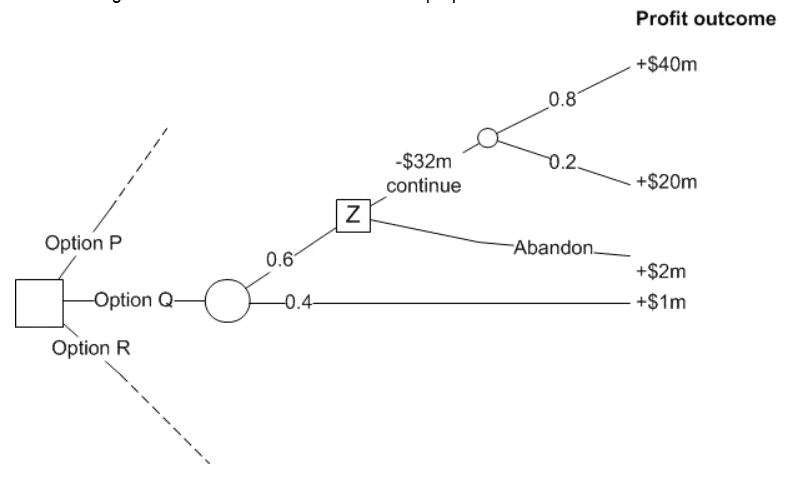

The following extract from a decision tree has been prepared for a decision that is to be made to choose between options P, Q and R.

What is the maximum expected value of profit at decision point Z?

Answer : A

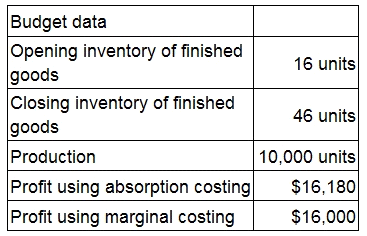

A company manufactures a single product. The following budgeted data applies to month 6:

What was the budgeted fixed production overhead for month 6?

Give your answer to the nearest whole $ (in '000s).

See Below Explanation:

Answer : A