CIPS Global Commercial Strategy L6M2 Exam Practice Test

SIMULATION

Discuss how the following can impact upon supply chain operations and business strategy:

1) Discrimination, equality and diversity

2) Redundancy and dismissal

3) Working time and payment

Answer : A

Impact of Employment Policies on Supply Chain Operations and Business Strategy

Introduction

Employment policies such as discrimination, equality and diversity, redundancy and dismissal, and working time and payment have a significant impact on supply chain operations and business strategy. These factors influence employee productivity, legal compliance, reputation, and operational efficiency.

For businesses operating in global supply chains, ensuring compliance with employment laws and ethical workforce practices is crucial to maintaining sustainability, cost efficiency, and risk management.

1. Impact of Discrimination, Equality, and Diversity on Supply Chain Operations and Business Strategy

Discrimination laws and diversity and inclusion (D&I) policies ensure fair treatment in the workplace.

Impact on Supply Chain Operations

Companies must prevent workplace discrimination across hiring, promotions, and supplier engagement.

Non-compliance with equality laws can lead to legal penalties, reputational damage, and operational disruptions.

Supply chain leaders must promote diverse supplier partnerships and inclusive hiring practices.

Example: Many multinational corporations, such as Unilever and IBM, have supplier diversity programs that prioritize working with minority-owned and women-owned businesses.

Impact on Business Strategy

Encourages innovation and diverse perspectives in problem-solving.

Enhances brand reputation and customer loyalty through ethical business practices.

Helps businesses attract top global talent by fostering an inclusive workplace.

Strategic Action: Businesses should implement anti-discrimination training and diversity recruitment strategies to create a fair and inclusive work environment.

2. Impact of Redundancy and Dismissal on Supply Chain Operations and Business Strategy

Redundancy and dismissal policies regulate how companies terminate employment due to economic downturns, automation, or restructuring.

Impact on Supply Chain Operations

Workforce reductions can disrupt production schedules and supplier relationships.

Companies must ensure fair redundancy policies to prevent legal claims or industrial action.

Automation may lead to worker displacement, requiring retraining programs.

Example: Ford's decision to restructure operations in the UK resulted in job losses, requiring compliance with UK redundancy laws and union negotiations.

Impact on Business Strategy

Must balance cost-cutting measures with employee morale and brand reputation.

Need to comply with national and international labor laws to avoid legal action.

Investing in employee retraining and redeployment can reduce negative effects of redundancy.

Strategic Action: Businesses should establish clear redundancy frameworks, provide severance packages, and offer outplacement support for affected employees.

3. Impact of Working Time and Payment on Supply Chain Operations and Business Strategy

Working time regulations and fair wage policies impact labor costs, productivity, and compliance.

Impact on Supply Chain Operations

Ensuring compliance with working time laws (e.g., UK Working Time Regulations 1998) prevents overworking employees.

Failure to meet minimum wage and overtime regulations can lead to legal disputes.

Supply chains must ensure fair pay for workers in offshore factories to meet ethical sourcing standards.

Example: The UK National Minimum Wage Act ensures fair wages, while the Modern Slavery Act (2015) prevents exploitation in global supply chains.

Impact on Business Strategy

Fair wages enhance employee motivation and reduce turnover.

Complying with wage and hour laws prevents reputational risks and fines.

Ethical pay practices attract conscious consumers and investors.

Strategic Action: Businesses should conduct regular wage audits and ensure global supplier compliance with fair labor laws.

Conclusion

Employment policies related to discrimination, redundancy, and working time/pay significantly impact supply chain operations and business strategy. Companies must ensure:

Diversity and equality policies to foster innovation and enhance reputation.

Ethical redundancy and dismissal processes to maintain legal compliance.

Fair wages and working hours to improve productivity and worker well-being.

By aligning HR policies with supply chain strategy, businesses can enhance efficiency, reduce risks, and build a sustainable competitive advantage.

SIMULATION

Describe and evaluate the use of the VRIO Framework in understanding the internal resources and competencies of an organisation.

Answer : A

The VRIO Framework: Understanding Internal Resources and Competencies

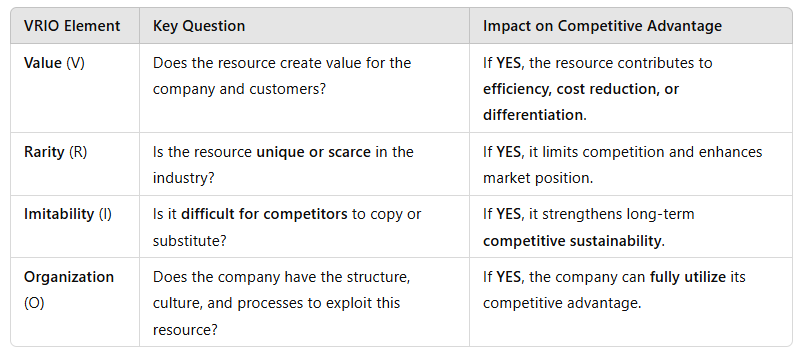

The VRIO Framework is a strategic analysis tool used to assess an organization's internal resources and competencies to determine whether they provide a sustainable competitive advantage. Developed by Jay Barney, VRIO stands for Value, Rarity, Imitability, and Organization.

1. Explanation of the VRIO Framework

The VRIO model evaluates whether a firm's resources and capabilities contribute to a sustained competitive advantage.

Example: Apple's software ecosystem (iOS, App Store) is valuable, rare, hard to imitate, and well-organized, giving it a sustainable competitive advantage.

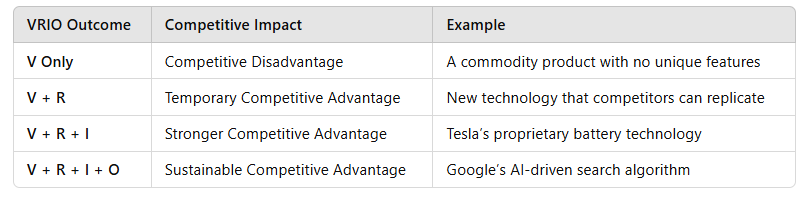

2. The Use of VRIO in Assessing Internal Resources and Competencies

Companies use the VRIO framework to identify which resources provide temporary or sustainable competitive advantages.

3. Advantages of Using VRIO in Strategic Decision-Making

Identifies Core Competencies -- Helps organizations focus on key strengths that drive long-term success.

Guides Investment Decisions -- Encourages businesses to invest in resources that are difficult to imitate.

Improves Competitive Strategy -- Helps firms differentiate between short-term vs. long-term advantages.

Example: Coca-Cola's brand equity is VRIO-positive, making it difficult for new entrants to replicate.

4. Limitations of the VRIO Framework

Ignores External Factors -- Unlike PESTLE or Porter's Five Forces, VRIO does not account for market conditions or regulatory changes.

Subjectivity in Resource Evaluation -- Assessing whether a resource is truly valuable or rare can be complex.

Lack of Actionable Steps -- VRIO identifies competitive strengths but does not provide strategies for leveraging them.

Example: A company may identify a rare talent pool, but poor organizational structure (O) can prevent it from leveraging this advantage.

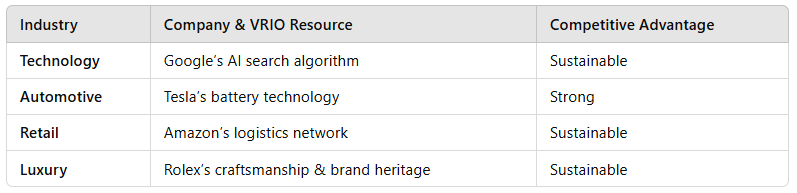

5. Application of VRIO in Business Strategy

Businesses across different industries use VRIO to assess their internal strengths:

Conclusion

The VRIO Framework is a valuable tool for evaluating internal resources and capabilities, allowing businesses to identify sustainable competitive advantages. However, it should be used alongside external analysis tools (e.g., PESTLE, SWOT) to ensure a comprehensive strategic assessment.

SIMULATION

Examine how an organisation can strategically position itself within the marketplace.

Answer : A

How an Organization Can Strategically Position Itself in the Marketplace

Strategic positioning is the process by which an organization differentiates itself from competitors and establishes a strong, sustainable presence in the market. It involves making key decisions regarding branding, pricing, customer engagement, and competitive advantage to attract and retain customers.

Below are the key strategies an organization can use to position itself strategically in the marketplace:

1. Competitive Strategy (Porter's Generic Strategies)

Organizations can use Michael Porter's Competitive Strategies to define their market position:

Cost Leadership -- Competing on price by offering the lowest-cost products or services.

Differentiation -- Offering unique, high-quality, or innovative products that stand out.

Focus (Niche Strategy) -- Targeting a specific market segment with specialized products or services.

Example:

Aldi (Cost Leadership) keeps prices low by optimizing supply chains.

Apple (Differentiation) uses innovation and brand exclusivity to dominate the premium tech market.

Rolls-Royce (Focus Strategy) targets a niche luxury segment instead of mass markets.

2. Strong Branding and Market Perception

Organizations must build a strong brand identity to differentiate themselves. This includes:

Consistent Branding -- Using logos, colors, and messaging that reinforce identity.

Emotional Connection -- Telling a brand story that resonates with customers.

Trust and Reputation -- Delivering quality products and services to establish credibility.

Example:

Coca-Cola uses global branding to evoke happiness and refreshment, maintaining strong market dominance.

Tesla markets itself as an innovative, eco-friendly brand, appealing to environmentally conscious consumers.

3. Innovation and Product Development

To maintain a competitive edge, companies must invest in innovation and continuously improve their products/services.

Technology Adoption -- Implementing cutting-edge solutions (e.g., AI, automation).

Customer-Centric Innovation -- Developing products based on customer needs.

First-Mover Advantage -- Being the first to introduce groundbreaking products.

Example:

Amazon's AI-driven supply chain ensures fast deliveries and high customer satisfaction.

Netflix's streaming model revolutionized entertainment consumption, making it an industry leader.

4. Digital Transformation and Market Reach

Organizations can use digital tools and platforms to enhance their strategic positioning:

E-commerce & Online Presence -- Expanding reach beyond physical locations.

Social Media & Influencer Marketing -- Engaging with customers through digital channels.

Data Analytics -- Using customer insights to make strategic decisions.

Example:

Nike's e-commerce growth and direct-to-consumer (DTC) model strengthened its competitive position.

Zara's fast fashion strategy, driven by data analytics, allows quick response to trends.

5. Sustainability and Corporate Social Responsibility (CSR)

Modern consumers prefer brands that demonstrate social and environmental responsibility. Companies can differentiate themselves by:

Sustainable Sourcing -- Using eco-friendly materials and ethical suppliers.

Corporate Ethics -- Promoting fair labor practices and social initiatives.

Carbon Footprint Reduction -- Committing to green energy and carbon neutrality.

Example:

Patagonia's sustainability-first strategy attracts eco-conscious consumers.

Unilever's ''Sustainable Living Plan'' enhances brand loyalty through ethical business practices.

6. Strategic Partnerships and Market Expansion

Organizations can strengthen their market position through collaborations and global expansion:

Mergers & Acquisitions -- Gaining market share by acquiring competitors.

Joint Ventures -- Partnering with companies for mutual growth.

New Market Entry -- Expanding into emerging markets.

Example:

Google acquiring YouTube enhanced its presence in digital content.

Starbucks' partnership with Nestl expanded its global coffee distribution.

Conclusion

Strategic positioning requires a clear understanding of competitive advantage, market needs, and innovative growth strategies. By leveraging cost leadership, differentiation, branding, innovation, digital transformation, sustainability, and partnerships, organizations can sustain long-term success in a competitive market.

SIMULATION

Discuss the following strategic decisions, explaining the advantages and constraints of each: Market Penetration, Product Development and Market Development.

Answer : A

Evaluation of Strategic Decisions: Market Penetration, Product Development, and Market Development

Introduction

Strategic decisions in business involve selecting the best approach to grow market share, increase revenue, and sustain competitive advantage. According to Ansoff's Growth Matrix, businesses can pursue four strategic directions:

Market Penetration (expanding sales in existing markets with existing products)

Product Development (introducing new products to existing markets)

Market Development (expanding into new markets with existing products)

Diversification (introducing new products to new markets)

This answer focuses on Market Penetration, Product Development, and Market Development, discussing their advantages and constraints.

1. Market Penetration (Increasing sales of existing products in existing markets)

Explanation

Market penetration involves increasing market share by:

Encouraging existing customers to buy more.

Attracting competitors' customers.

Increasing promotional efforts.

Improving pricing strategies.

Example: Coca-Cola uses aggressive marketing, promotions, and pricing strategies to increase sales in existing markets.

Advantages of Market Penetration

Low Risk -- No need for new product development.

Cost-Effective -- Uses existing infrastructure and supply chain.

Builds Market Leadership -- Strengthens brand loyalty and customer retention.

Quick Revenue Growth -- Increased sales generate higher profits.

Constraints of Market Penetration

Market Saturation -- Limited growth potential if the market is already saturated.

Intense Competition -- Competitors may retaliate with price cuts and promotions.

Diminishing Returns -- Lowering prices to attract customers can reduce profitability.

Strategic Consideration: Businesses should assess customer demand and competitive intensity before implementing a market penetration strategy.

2. Product Development (Introducing new products to existing markets)

Explanation

Product development involves launching new or improved products to meet evolving customer needs. This can include:

Innovation -- Developing new features or technology.

Product Line Extensions -- Introducing variations (e.g., new flavors, models, packaging).

Customization -- Tailoring products to specific customer preferences.

Example: Apple frequently launches new iPhone models to attract existing customers.

Advantages of Product Development

Higher Customer Retention -- Keeps existing customers engaged with new offerings.

Brand Differentiation -- Strengthens competitive advantage through innovation.

Increases Revenue Streams -- Expands product portfolio and market opportunities.

Constraints of Product Development

High R&D Costs -- Requires investment in innovation and testing.

Market Uncertainty -- New products may fail if not aligned with customer needs.

Risk of Cannibalization -- New products may reduce sales of existing products.

Strategic Consideration: Businesses should conduct market research, prototyping, and feasibility analysis before launching new products.

3. Market Development (Expanding into new markets with existing products)

Explanation

Market development involves selling existing products in new geographical areas or customer segments. Strategies include:

Expanding into international markets.

Targeting new demographics (e.g., different age groups or industries).

Entering new distribution channels (e.g., e-commerce, retail stores).

Example: McDonald's expands into new countries, adapting its menu to local preferences.

Advantages of Market Development

Access to New Revenue Streams -- Increases customer base and sales.

Diversifies Market Risk -- Reduces dependency on a single region.

Leverages Existing Products -- No need for costly product innovation.

Constraints of Market Development

Cultural and Regulatory Barriers -- Differences in consumer behavior, legal requirements, and competition.

High Entry Costs -- Requires investment in marketing, distribution, and local partnerships.

Operational Challenges -- Managing supply chains and logistics in new markets.

Strategic Consideration: Businesses should conduct market analysis and risk assessments before expanding internationally.

Conclusion

Each strategic decision has unique benefits and challenges:

Market Penetration is low-risk but limited by market saturation.

Product Development drives innovation but requires high investment.

Market Development expands revenue streams but involves cultural and regulatory challenges.

The best approach depends on a company's competitive position, financial resources, and long-term growth objectives.

SIMULATION

Evaluate the following approaches to supply chain management: the Business Excellence Model, Top-Down Management Approach and Six Sigma

Answer : A

Evaluation of Approaches to Supply Chain Management

Introduction

Effective supply chain management (SCM) is critical for organizations to enhance efficiency, reduce costs, and improve customer satisfaction. Various management approaches help organizations optimize their supply chain performance. Three widely recognized approaches include:

Business Excellence Model (BEM) -- A framework for continuous improvement.

Top-Down Management Approach -- A hierarchical decision-making structure.

Six Sigma -- A data-driven methodology for process improvement.

Each approach has strengths and limitations when applied to supply chain management.

1. Business Excellence Model (BEM) in Supply Chain Management

Explanation

The Business Excellence Model (BEM) is a holistic framework used to assess and improve business performance. The European Foundation for Quality Management (EFQM) Excellence Model is one of the most common BEM frameworks.

It focuses on 9 key criteria: Leadership, Strategy, People, Partnerships & Resources, Processes, Customer Results, People Results, Society Results, and Business Performance.

Application in Supply Chain Management

Encourages continuous improvement in supplier relationships and logistics.

Focuses on customer-centric supply chain strategies.

Promotes collaboration with suppliers and stakeholders to optimize efficiency.

Example: Toyota's Lean Supply Chain follows BEM principles to maintain supplier partnerships and quality improvement.

Evaluation

Advantages

Provides a structured framework for evaluating supply chain performance.

Enhances collaboration between internal teams and external suppliers.

Focuses on quality management and customer satisfaction.

Limitations

Can be complex and resource-intensive to implement.

Requires cultural change and strong leadership commitment.

2. Top-Down Management Approach in Supply Chain Management

Explanation

The Top-Down Management Approach follows a hierarchical structure where decisions are made by senior management and communicated downward. This approach ensures centralized decision-making and strong leadership control.

Application in Supply Chain Management

Ensures consistency in supply chain policies and strategic direction.

Facilitates quick decision-making in procurement and logistics.

Helps maintain compliance with regulatory standards and corporate policies.

Example: Amazon's Supply Chain Strategy is largely top-down, with executives making key strategic decisions on warehousing, delivery, and automation.

Evaluation

Advantages

Ensures strong leadership direction in supply chain management.

Reduces confusion in decision-making by maintaining clear authority.

Useful for large-scale global supply chains that need standardization.

Limitations

Can be rigid and slow to adapt to changing supply chain disruptions.

May reduce innovation and employee engagement in problem-solving.

Less effective in dynamic, fast-changing industries.

3. Six Sigma in Supply Chain Management

Explanation

Six Sigma is a data-driven methodology aimed at reducing defects and improving quality. It follows the DMAIC cycle (Define, Measure, Analyze, Improve, Control) to enhance process efficiency and minimize errors.

Application in Supply Chain Management

Helps identify waste and inefficiencies in supply chain processes.

Reduces defects and errors in procurement, logistics, and inventory management.

Enhances supplier performance evaluation through data analysis.

Example: General Electric (GE) used Six Sigma to improve supply chain efficiency, reducing defects and operational costs.

Evaluation

Advantages

Reduces supply chain disruptions by improving process reliability.

Uses data-driven decision-making for procurement and logistics.

Improves supplier quality management.

Limitations

Requires intensive training and certification (Black Belt, Green Belt, etc.).

Can be too rigid for industries requiring flexibility and innovation.

Implementation may be costly and time-consuming.

Conclusion

Each approach offers unique benefits for supply chain management:

BEM ensures a holistic, continuous improvement framework for supply chains.

Top-Down Management provides strong leadership direction and centralized decision-making.

Six Sigma improves process quality and operational efficiency.

Organizations should combine these approaches based on their business model, industry requirements, and strategic goals to optimize supply chain performance.

SIMULATION

Explain the use of forward and future contracts in the commodities market

Answer : A

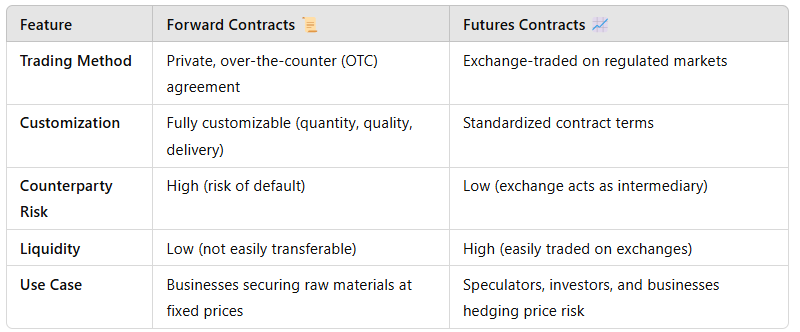

Use of Forward and Futures Contracts in the Commodities Market

Introduction

The commodities market involves the trading of physical goods such as oil, gold, agricultural products, and metals. Due to price volatility, businesses and investors use derivative contracts like forward and futures contracts to manage price risk and ensure stability in supply chains.

Both contracts allow buyers and sellers to agree on a fixed price for a future date, but they differ in terms of standardization, trading methods, and risk exposure.

1. Forward Contracts (Private, Custom Agreements)

Definition

A forward contract is a customized agreement between two parties to buy or sell a commodity at a specified price on a future date. It is a private, over-the-counter (OTC) contract, meaning it is not traded on an exchange.

Key Characteristics:

Customizable terms (quantity, delivery date, price).

Direct agreement between buyer and seller.

Used for hedging against price fluctuations.

Example: A coffee producer agrees to sell 10,000kg of coffee to a distributor in 6 months at a fixed price of $5 per kg, protecting both parties from price swings.

Advantages of Forward Contracts

Tailored to buyer/seller needs -- Customizable quantity, quality, and delivery terms.

Reduces price uncertainty -- Locks in a price, protecting against market fluctuations.

No upfront cost -- No initial margin or collateral required.

Disadvantages of Forward Contracts

High counterparty risk -- If one party defaults, the other may face financial losses.

Not regulated or publicly traded -- Higher risk of contract disputes.

Limited liquidity -- Harder to transfer or sell compared to futures contracts.

Best for: Companies looking for customized price protection in procurement or sales (e.g., food manufacturers, oil refineries).

2. Futures Contracts (Standardized, Exchange-Traded Agreements)

Definition

A futures contract is a standardized agreement to buy or sell a commodity at a predetermined price on a future date. These contracts are traded on organized exchanges (e.g., Chicago Mercantile Exchange (CME), London Metal Exchange (LME)).

Key Characteristics:

Highly regulated and standardized (fixed contract sizes and terms).

Exchange-traded Increased liquidity and price transparency.

Requires initial margin and daily settlements (mark-to-market system).

Example: A wheat farmer uses futures contracts on the Chicago Board of Trade (CBOT) to lock in wheat prices before harvest, avoiding potential price drops.

Advantages of Futures Contracts

Lower counterparty risk -- Exchanges guarantee contract settlement.

High liquidity -- Easily bought or sold on futures markets.

Price transparency -- Publicly available pricing and standardized contracts.

Disadvantages of Futures Contracts

Less flexibility -- Fixed contract sizes and expiration dates.

Margin requirements -- Traders must maintain a margin account, requiring cash reserves.

Potential for speculative losses -- Prices fluctuate daily, leading to possible margin calls.

Best for: Large-scale buyers/sellers, investors, and companies needing risk management in commodity markets.

3. Key Differences Between Forward and Futures Contracts

Key Takeaway: Forwards offer flexibility but higher risk, while futures provide standardization and liquidity.

4. Application of Forward and Futures Contracts in the Commodities Market

Forwards Used By:

Food manufacturers -- Locking in wheat, sugar, or coffee prices for future production.

Oil refineries -- Securing crude oil prices to manage fuel costs.

Mining companies -- Pre-agreeing on metal prices to secure revenue streams.

Futures Used By:

Airlines -- Hedging against fluctuating fuel prices.

Investors -- Speculating on gold, oil, or agricultural prices for profit.

Governments -- Stabilizing national food or energy reserves.

5. Conclusion

Both forward and futures contracts are essential tools in the commodities market for price risk management.

Forward contracts are customizable but riskier, making them suitable for businesses with specific procurement needs.

Futures contracts offer liquidity and reduced counterparty risk, making them ideal for investors and large corporations managing price volatility.

Organizations must choose the right contract based on their risk tolerance, market exposure, and financial objectives.

SIMULATION

Discuss 5 tasks of strategic management

Answer : A

Five Key Tasks of Strategic Management

Introduction

Strategic management involves formulating, implementing, and evaluating a company's long-term goals to achieve competitive advantage. It ensures that an organization effectively aligns its resources, capabilities, and market position to meet its objectives.

The strategic management process can be broken down into five key tasks:

1. Setting Vision, Mission, and Objectives

Strategic management begins with defining the organization's purpose and direction.

Vision Statement: Describes the long-term aspirations of the business.

Mission Statement: Outlines the core purpose and values.

Objectives: Establish specific, measurable goals (e.g., market expansion, profitability targets).

Example:

Tesla's vision is to accelerate the world's transition to sustainable energy.

XYZ Construction might set a strategic objective to become the UK's leading sustainable housing developer.

2. Environmental Scanning and Analysis

Organizations must assess internal and external environments to identify opportunities and threats.

External Analysis -- Uses PESTLE (Political, Economic, Social, Technological, Legal, Environmental) and Porter's Five Forces to assess market conditions.

Internal Analysis -- Uses VRIO (Value, Rarity, Imitability, Organization) and SWOT (Strengths, Weaknesses, Opportunities, Threats) to evaluate internal capabilities.

Example:

A global beverage company may conduct PESTLE analysis to assess regulatory changes in sugar taxation.

XYZ Construction may analyze rising material costs and explore alternative suppliers.

3. Strategy Formulation

After analyzing the environment, the organization develops its strategic choices:

Corporate-Level Strategy: Determines growth direction (e.g., diversification, mergers, acquisitions).

Business-Level Strategy: Focuses on competitive advantage (e.g., cost leadership, differentiation, or niche market strategies).

Functional-Level Strategy: Aligns departments (procurement, HR, marketing) with the corporate strategy.

Example:

XYZ Construction could adopt a cost leadership strategy by sourcing materials more efficiently.

Apple follows a differentiation strategy by focusing on innovation and design.

4. Strategy Implementation

Once a strategy is formulated, it must be executed effectively.

Organizational Structure: Ensures the right teams and leadership are in place.

Change Management: Employees must accept and support the strategy (overcoming resistance to change).

Resource Allocation: Financial, technological, and human resources must be assigned effectively.

Example:

XYZ Construction might invest in new project management software to improve efficiency.

Amazon continuously optimizes its logistics network to implement its cost leadership strategy.

5. Strategy Evaluation and Control

Organizations must monitor performance to ensure the strategy remains effective.

Key Performance Indicators (KPIs): Measure progress (e.g., sales growth, cost reduction).

Feedback & Adaptation: Adjust strategies based on market trends and competitor actions.

Risk Management: Identify and mitigate risks (e.g., economic downturns, supply chain disruptions).

Example:

XYZ Construction may review project completion times and adjust its approach for greater efficiency.

McDonald's continuously adapts its menu based on regional preferences and customer feedback.

Conclusion

The five key tasks of strategic management---setting objectives, environmental scanning, strategy formulation, strategy implementation, and evaluation---help organizations achieve long-term success and competitive advantage. Effective strategic management ensures that companies stay agile in dynamic markets while making informed, data-driven decisions.