CSI Canadian Securities Course Exam 2 CSC2 Exam Practice Test

In March of this year, a client buys 1,000 PIL inc, common shares at $16 per share and pays a commission of $25 on the purchase. Several months later in the same year, the client sell the shares at $12 per share and pays commission of $50 on the sale. What is the client's allowable capital loss on the transaction?

Answer : A

To calculate the allowable capital loss, we must first determine the adjusted cost base (ACB) and the proceeds of disposition (POD), then subtract the latter from the former. Commissions on both the purchase and sale are included in the calculation.

Step-by-Step Explanation:

Purchase Details:

Number of shares purchased: 1,000

Purchase price per share: $16

Total purchase cost before commission: $16 1,000 = $16,000

Add purchase commission: $25

Adjusted cost base (ACB): $16,000 + $25 = $16,025

Sale Details:

Number of shares sold: 1,000

Sale price per share: $12

Total sale proceeds before commission: $12 1,000 = $12,000

Deduct sale commission: $50

Proceeds of Disposition (POD): $12,000 - $50 = $11,950

Capital Loss Calculation:

Capital loss = ACB - POD

Capital loss = $16,025 - $11,950 = $4,075

Allowable Capital Loss:

In Canada, 50% of the capital loss is allowable for tax purposes.

Allowable capital loss = 50% $4,075 = $2,038

Final Answer:

Option A ($2,038): Correct.

Option B ($2,025): Incorrect; likely excludes commissions or contains a minor calculation error.

Option C ($1,925): Incorrect; this does not account for the full adjusted cost base or allowable percentage.

Option D ($2,013): Incorrect; this likely contains a rounding error or miscalculation.

Reference to Canadian Securities Course Exam 2 Study Materials:

Volume 2, Chapter 24 -- Canadian Taxation

Discusses the calculation of adjusted cost base (ACB), proceeds of disposition (POD), and allowable capital losses.

Volume 1, Chapter 11 -- Corporations and Their Financial Statements

Details financial concepts like capital gains, losses, and the treatment of commissions in securities transactions.

Volume 2, Chapter 26 -- Working with the Retail Client

Covers tax implications and planning for securities transactions.

What bond should an advisor recommend to someone who wants to hold bonds and maximize potential cap-tai gams when interest rates are expected to fall?

Answer : D

A long-term bond with a low coupon will maximize capital gains when interest rates fall. Here's why:

Long-term bonds are more sensitive to interest rate changes due to their longer duration, which amplifies the price movement.

Low coupon bonds are more affected by changes in interest rates compared to high coupon bonds because more of their value comes from the principal repayment rather than periodic interest payments.

Other options:

Short-term bonds: Have lower duration and less sensitivity to interest rate changes, so they do not maximize capital gains.

High coupon bonds: Are less sensitive to interest rate changes because of their higher periodic cash flows.

Volume 1, Chapter 7: Fixed-Income Securities: Pricing and Trading, section on 'Impact of Maturity and Coupon on Bond Prices' explains the relationship between interest rate changes, bond duration, and price sensitivity.

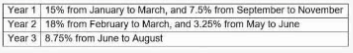

Over the previous three calendar years, fund LMO had five drawdowns as follows:

What was the maximum drawdown during this time period?

Answer : A

When considering management accounts, what is most accurate regarding model-based account management?

Answer : D

Model-based account management refers to discretionary accounts where advisors execute trades following a predefined model portfolio. Client consent is crucial as advisors must adhere to fiduciary responsibilities and ethical standards. This consent is typically obtained through agreements and clear disclosure documents when opening such accounts. The necessity for client approval ensures alignment with the investor's risk tolerance and financial objectives.

Tax loss selling and solicitation are unrelated to the operational mechanics of model-based accounts, while the emphasis on short-term use contradicts the long-term nature of these accounts.

CSC Volume 2, Chapter 25: Fee-Based Accounts -- Documentation for Managed Accounts.

CSC Volume 2, Chapter 26: Working with Retail Clients -- Ethical Standards and Client Consent Requirements.

Where would the description d a company's fixed assets normally be found?

Answer : C

The description of a company's fixed assets, including details about their nature, valuation methods, and depreciation, is typically found in the notes to the financial statements. These notes provide additional context, explanations, and details about the figures presented in the financial statements. The statement of financial position will list fixed assets, but the comprehensive description is found in the notes.

Volume 1, Chapter 11: Corporations and Their Financial Statements, section on 'Notes to the Financial Statements' describes how notes are used to provide critical details about items in the financial statements, including fixed assets.

How do index-tracking ETFs differ from index mutual funds?

Answer : B

SK AI-Equity Mutual Fund reported a year-end NAVPS of $25.50, a beginning of the year NAVPS of $21.50, and a dividend yield of 4.34%. What was the performance of the SK fund assuming reinvestment of all dividends and that no additions or withdrawals were made?

Answer : A