Pegasystems Certified Pega Decisioning Consultant (PCDC) 87V1 PEGAPCDC87V1 Exam Practice Test

U+, a retail bank, recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal. The bank does not want any bias except to satisfy the eligibility condition Age >=18. As a Decisioning Consultant, how will you configure the ethical bias policy to allow a minimum bias on age?

Answer : D

Ethical Bias Policy Configuration:

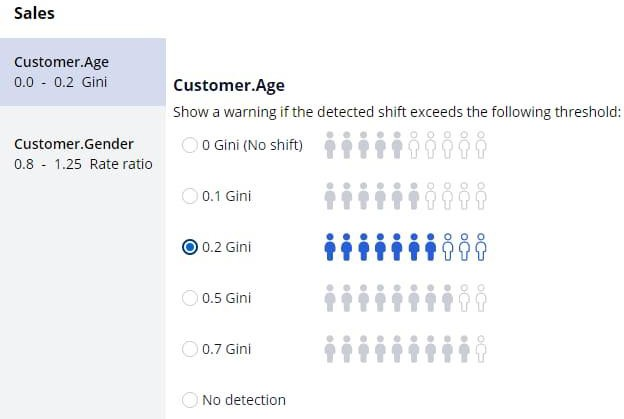

To allow minimal bias on age while ensuring eligibility (Age >= 18), an appropriate Gini coefficient threshold needs to be set.

The Gini coefficient measures statistical inequality, with 0 representing perfect equality and higher values indicating more bias.

Choosing the Gini Threshold:

A 0.1 Gini coefficient is a low threshold that allows minimal bias.

It ensures that the actions are distributed fairly among customers while still respecting the eligibility condition.

Detailed Explanation:

Setting a 0.1 Gini coefficient allows for slight variations in distribution, which is sufficient to accommodate the Age >= 18 requirement without introducing significant bias.

Verification from Pega Documentation:

The Pega Customer Decision Hub User Guide explains the use of Gini coefficients for measuring and setting thresholds to control bias in decisioning strategies.

U+ Bank's marketing department currently promotes various credit card offers by sending emails to qualified customers. Now the bank wants to limit the number of emails sent to their customers irrespective of past outcomes with a particular offer and customer. Which of the following options allows you to implement this business requirement?

Answer : A

To limit the number of emails sent to customers irrespective of past outcomes with a particular offer and customer, you can implement customer contact limits. Customer contact limits are used to control the number of interactions a customer can receive over a specific period on a particular channel, ensuring that customers are not overwhelmed with too many messages.

Setting constraints and contact policy limits (Page 34-35)

Creating a contact policy (Page 66)

Myco, a telco, currently promotes 24-month contracts with a free handset plus data plan, for example, MyPhone 11 and unlimited calls and dat

a. The business structure has a sales issue/plans group that contains all actions, which are currently handsets.

Now, the company wants to introduce some new plans without handsets. So, the term handsets no longer applies to the new actions. At what level in the hierarchy can you rename the plans to reflect the new situation?

Answer : A

Understanding the Context: Myco, a telco, wants to introduce new plans without handsets. Currently, their business structure under the sales issue/plans group contains actions that are handsets.

Business Structure: In Pega Customer Decision Hub, the business structure is organized into issues and groups.

Action Naming: To reflect the new situation where plans do not include handsets, the term 'handsets' needs to be changed.

Level of Change: The appropriate level for renaming the plans to reflect this new structure is at the Issue level. At this level, the business context for actions is defined, and changes here will apply to all actions under that issue.

Reference: As per the documentation, changes to business issues and groups should be done at the issue level to ensure that the new context is accurately represented across all relevant actions.

Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach.

The company is introducing a new data plan.

To offer the new data plan, what must the mobile company focus on when implementing the Next-Best-Action paradigm?

Answer : D

When implementing the Next-Best-Action paradigm to offer the new data plan, the mobile company should focus on 'Customer relevancy and business profitability.' This means that the company needs to ensure that the offers are relevant to individual customers based on their needs, preferences, and behavior, while also aligning these offers with the company's business objectives to ensure profitability. This customer-centric approach leverages Pega's predictive and adaptive analytics to personalize offers and maximize both customer satisfaction and business outcomes.

In Pega Customer Decision Hub, the characteristics of an action are defined by using

Answer : A

In Pega Customer Decision Hub, the characteristics of an action are defined by using properties. Properties are used to capture specific details about an action, such as the type of offer, the conditions under which it should be presented, and other relevant data that influence decision-making. These properties ensure that the actions are personalized and relevant to the customer.

Reference module: Creating and understanding decision strategies. In a Prioritize component, the top action can be determined based on the value of _______.

Answer : A

Introduction to Prioritize Component:

The Prioritize component in Pega Decisioning is used to order actions based on specific criteria.

This component evaluates the importance or priority of different actions to determine which should be executed first.

Understanding Propensity:

Propensity is a prediction of the likelihood that a customer will respond positively to a particular action.

It is a key factor in decision-making processes as it reflects the customer's predicted behavior based on past interactions and other data.

Role of Propensity in Prioritize Component:

The primary function of the Prioritize component is to rank actions.

This ranking is typically based on the propensity value, which is calculated using predictive models.

The action with the highest propensity is considered the top action because it has the highest predicted likelihood of a positive customer response.

Verification from Pega Documentation:

According to Pega's guidelines on creating and understanding decision strategies, propensity is a standard and recommended metric for prioritizing actions within the Prioritize component.

Reference module: Creating and understanding decision strategies. In a decision strategy, to use a customer property in an expression, you _____.

Answer : A

Customer Properties - These are attributes related to the customer, such as demographics, behavior, and engagement history.

Expression Syntax:

When defining expressions in decision strategies, customer properties must be prefixed with 'Customer.'

For example, to use the customer's age, you write Customer.Age.

Steps:

In the decision strategy, select the component where you need to use the customer property.

Write the expression using the 'Customer' prefix.

Pega Customer Decision Hub User Guide 8.6, Section 'Using customer properties in decision strategies,' explains the required syntax for including customer properties in expressions.